Public Servants Get a Big, Beautiful Budget

Breaking down what Budget 2025 means to public servants and the public service.

Prime Minister Carney’s Canada Strong version of a ‘big, beautiful budget’ has arrived! It’s both everything he said he would do and nothing some expected he would do. For public servants, though, his promise of “sacrifice” and “generational change” feel quite real. They are fearful about what’s ahead. As individuals, maybe, with positions being cut. As an institution, there’s nothing to be fearful about. It’s past time for this real, but actually measured, reckoning.

Consider this: AFTER the comprehensive expenditure review and AFTER three years, the federal government will STILL have its largest workforce ever. It will have shorn itself of a projected 40,000 public servants not through arbitrary cuts but mostly through managed attrition and workforce adjustments or employee buyouts.

Not nothing, but not an existential crisis for the state of public service in Canada now or later. How deputy ministers and their management teams realize the savings targets they’ve been given is still up for grabs. But directions and intent are clearer now than ever before

Let’s break it all down.

What’s the What?

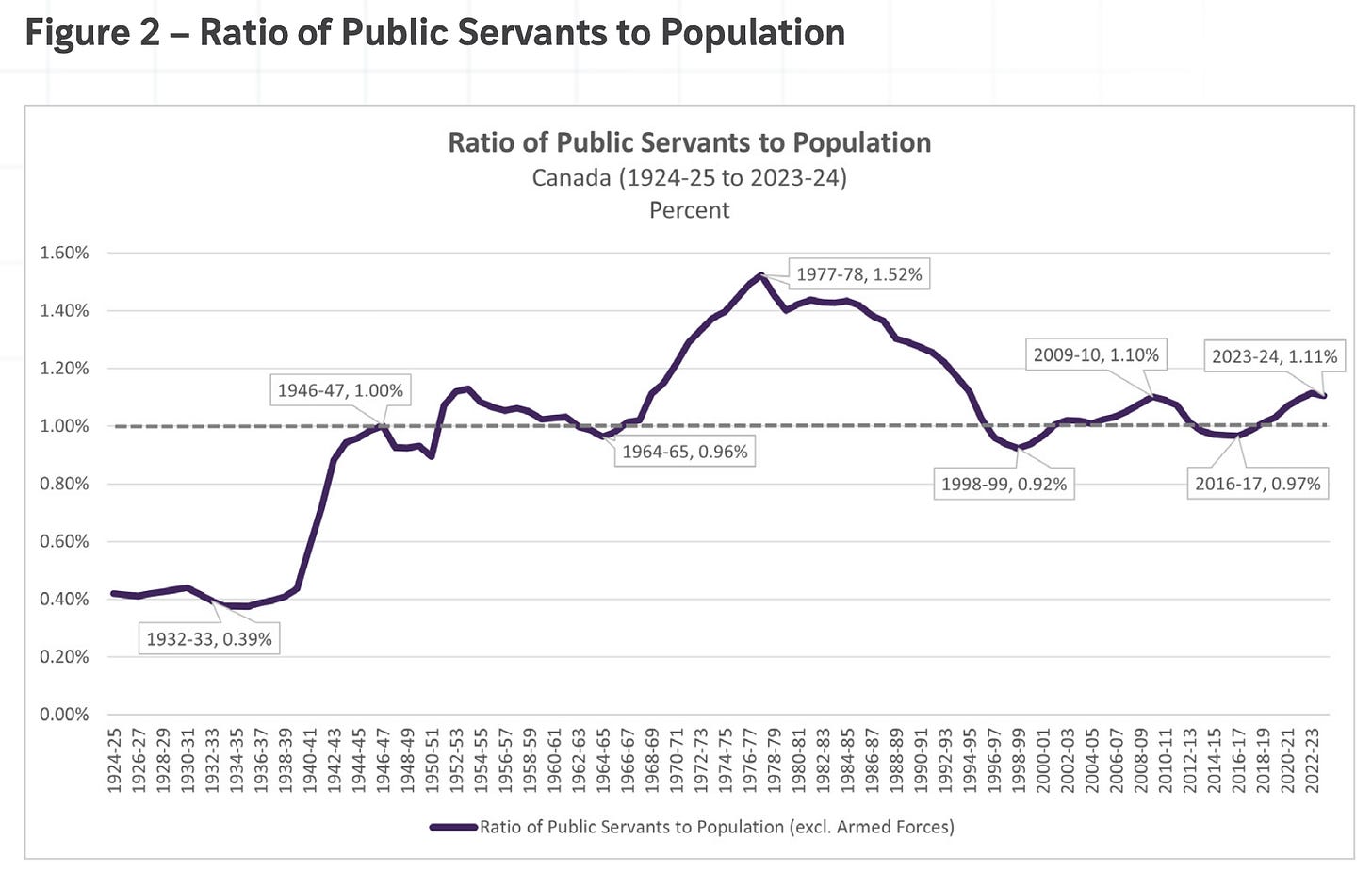

First, the big picture and a big chart from the Budget to illustrate. It shows the size, growth and budgeted reduction in the number of public servants indexed against the size and growth of Canada’s overall population. The working thesis is that they should match. You should not have a public service that is proportionally larger than the population it serves. You can see that we have that now and will yet till the end of this decade at least.

So, the Budget is making a case not for disproportionate cuts to the size of the federal public service but a recalibration of sorts. It is down-sizing government to right-size it, population-wise. You can’t “spend less and invest more” without touching the public service.

How mean (the root of meaningful) is this? Here’s some historical perspective. Check this figure1 showing that same indexed ratio of public servants to population way back to the Roaring Twenties of the last century:

It was Father Pierre Trudeau who blew the lid off government hiring in his first three terms and son Justin who did the same in his three terms. The chart makes clear that that for all the talk about public service reform or transformation, it is ALWAYS deteriorating economic and financial circumstances that drives public service headcount reduction. Each downturn in numbers aligned a downturn in the economy. Majority governments help too (Chretien, Mulroney, Harper, and now … almost, Carney) when PMs feel they have more political breathing space. Governments never seem to “modernize” the public service until they’re forced to.

The ups and downs of federal public service growth is set out in this figure below:

Big ups in the Second World War period; another upswing in the Liberal governments of Lester Pearson and Pierre Elliott Trudeau; incremental downsizing in the Brian Mulroney years initiated by the Nielsen Task Force; a serious cut in the Chretien years which he proceeded to reverse somewhat as time went on; status quo under Stephen Harper until the 2008/09 Great Recession; steady growth under Justin Trudeau; and, well, here we are today.

Is this draconian? Guess what? The Budget has a chart for that too!

The answer is ‘no, not really, compared to Jean Chretien but, yes, maybe, if you think Stephen Harper’s cuts were draconian’.

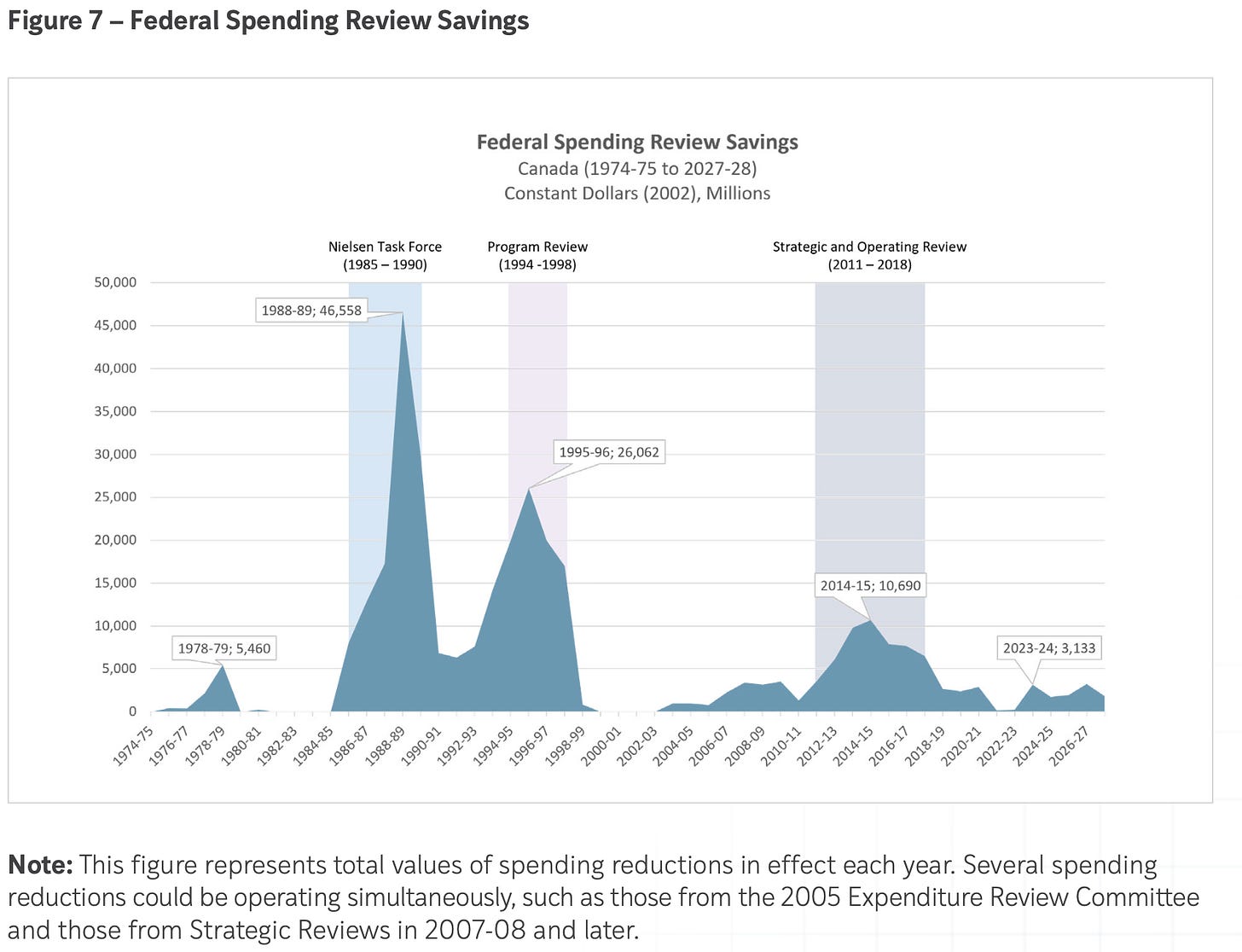

The figure below compares the results of the four previous program and service reviews and resulting expenditure reductions going back to 1995. The Carney one is projected to be more than Harper’s (take that Conservatives!) but less than the definitely draconian Chretien/Martin budget of 1995 when Canada was hitting a fiscal wall.

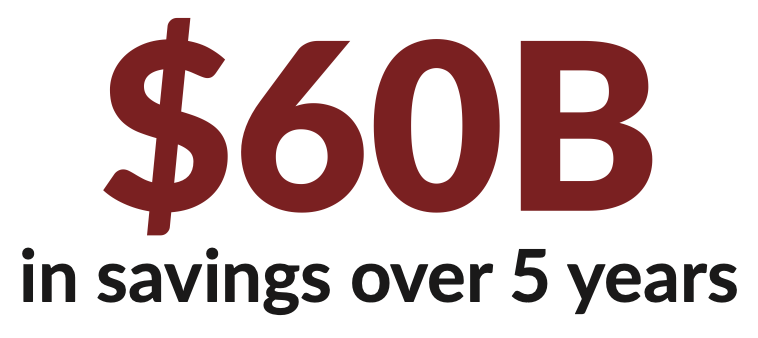

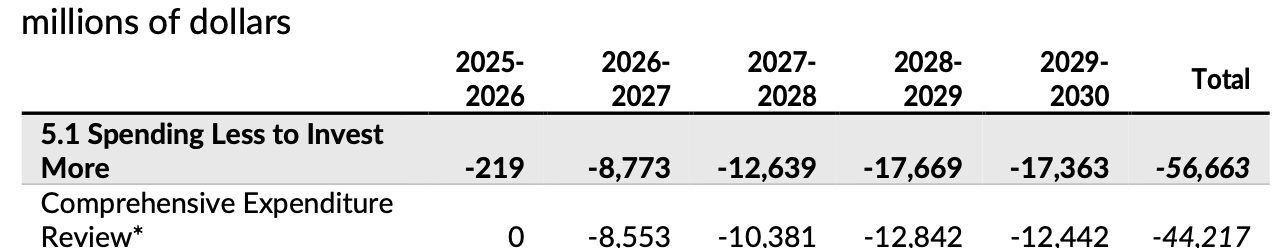

The Carney Budget forecasts $44.2 billion in cumulative savings over 4 years or EVEN MORE as the document flourishes!

The Budget provides tables for both 4 and 5-year periods but the more detailed are the former. It’s a trick of the trade to show ‘more’ by extending the forecast period for one or more fiscal years. We will avoid that temptation and stick with the $44.2 billion amount in planned savings. In 2028/29, that amount is forecast to be $12.4 billion in government savings. Here’s the Budget line from page 222.

I compared the Chretien/Carney expenditure review processes in a previous Substack post here. This now official number above is on track (maybe even a bit higher) than what was being bandied about when I first wrote about it. For more context, here’s a chart I found comparing the results for each of the four major spending review exercises spanning the past 50 years2:

In relative effort terms, the Mulroney and Chretien reviews and expenditure reductions considerably outpaced any subsequent efforts, probably because the need was greater.

What’s the How?

How will the government go about achieving this $44 billion in savings?

The ‘how’ is spelled out in Chapter 5 of the Budget: Creating a More Efficient and Effective Government. Three “themes” are listed to capture the savings:

Modernising Government Operations = $25.2 billion in savings

increasing the efficiency of back-office and administrative functions, leveraging new technology, and limiting spending on discretionary travel and training, and the use of external consultants

Streamlining Program Delivery = $1.5 billion in savings

streamlined program delivery to improve services and reduce duplication

Recalibrating Government Programs = $17.5 billion in savings

opportunities to refocus several programs that will help prioritize programs that will deliver the greatest impact.

Total savings = $44.2 billion.

The budget breaks these three themes down for each of the next four years, here (the first 3 lines are our focus):

You can see that for all the talk about more efficient, streamlined program delivery, it provides only a very modest contribution - 3% - to actual savings. Why? The federal government is not in the classic program service delivery role that provinces or municipalities perform. So, fewer savings across government to be had. Only 6 departments or agencies are slated for savings from “Streamlining Program Delivery”:

Immigration, Refugees, and Citizenship - $821M cumulative ($259 ongoing)

Energy and Natural Resources - $300M cumulative ($143M ongoing)

Employment and Workforce Development - $152M cumulative ($50M ongoing)

Innovation, Science and Industry - $98M cumulative ($27M ongoing)

Public Health Agency - $76M cumulative ($28M ongoing)

Housing, Infrastructure and Communities - $75M cumulative ($23M ongoing)

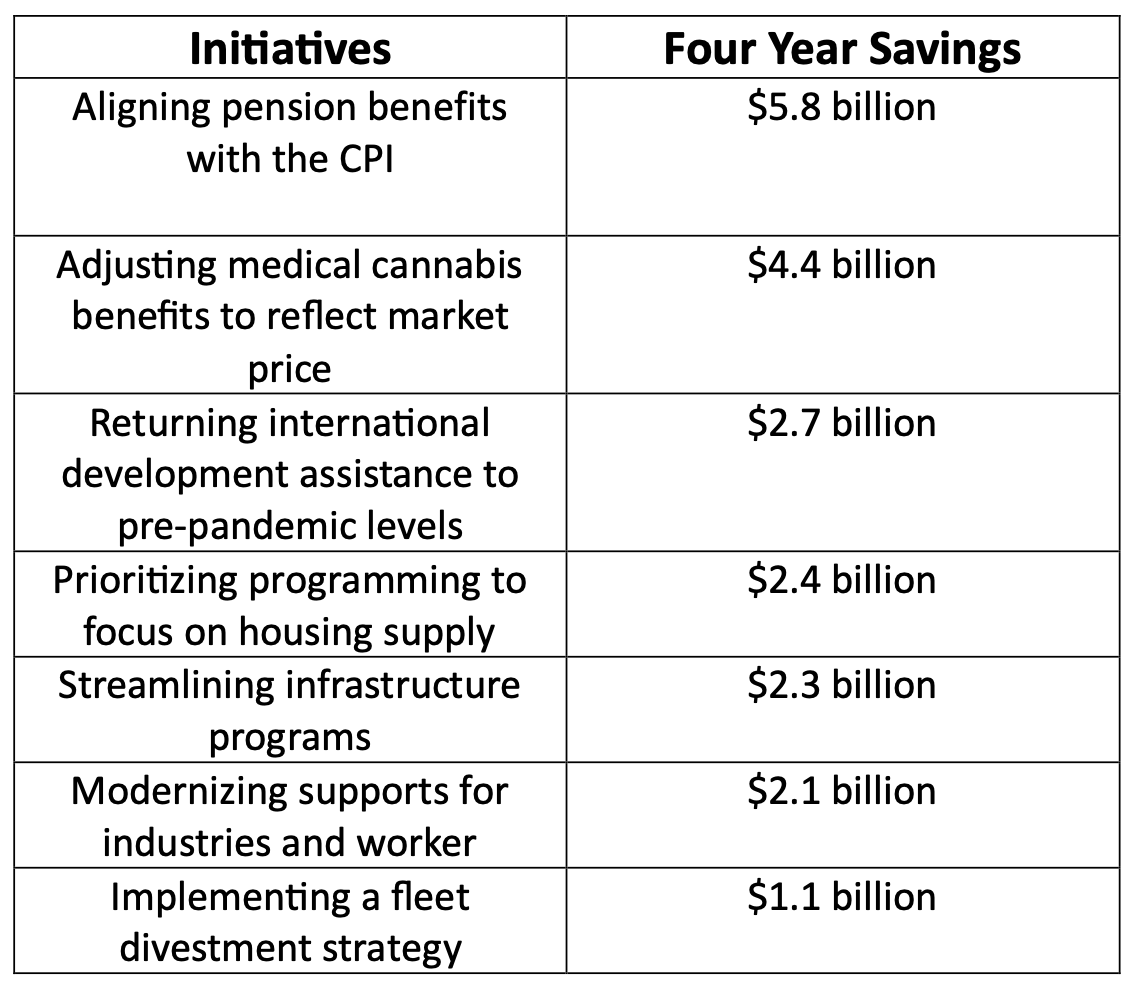

To top it off, the Budget anticipates savings of only $600 million over 4 years for what is called “Streamlining Government Operations" -”to reduce inefficiencies in daily operations and consolidate back-office operations”, as they put it. The real heavy lifting lies with the other two themes, with almost half of the planned savings - $20.8 billion - coming from just 7 initiatives. These are:

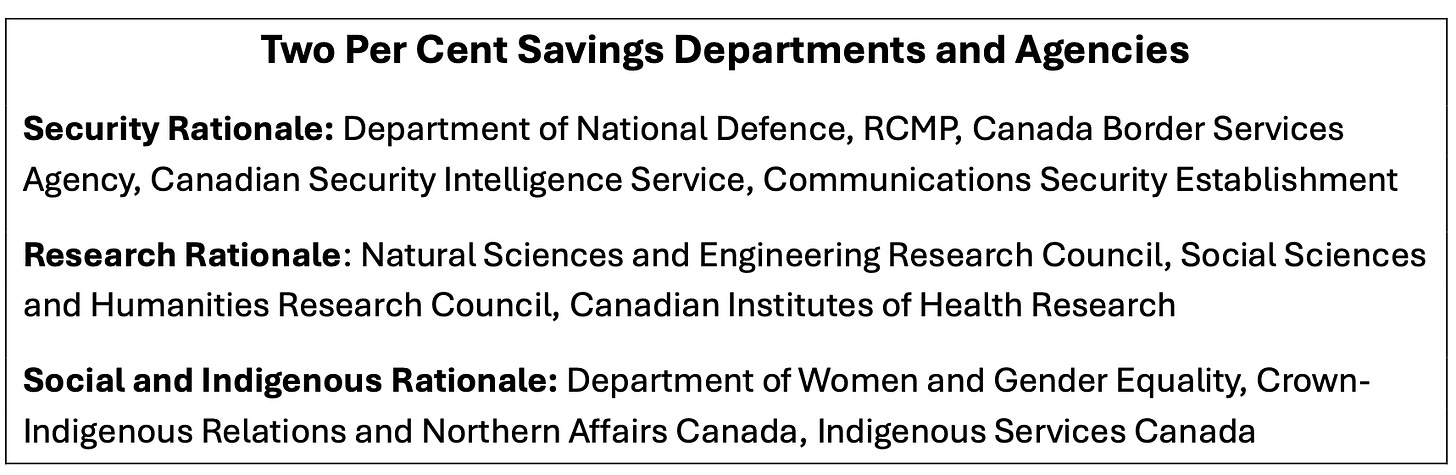

Spare the Pain, not Share It: While most departments and agencies are expected to find 15% savings, some are let off lightly with only a 2% savings target. This reflects a specific political and policy choice by the government to spare, not share the pain. These are:

What’s it all Mean?

Five top-line takeaways:

First, these are manageable, even overdue, reductions to the size of the public service but there will be cuts. Many will be easy to achieve since a lot of hires were temporary and took place during the pandemic. Excising those positions is relatively simple. Others, less so and some time needed to accomplish. Attrition will be insufficient on its own to achieve the 40,000 reduction. The government knows this. That’s why they are offering this - $1.19B over 5 years in voluntary retirement incentives - to smooth the way, beginning this FY:

This will be done by amending the Public Service Superannuation Act and the Income Tax Regulations to offer a voluntary Early Retirement Incentive program through the Public Service Pension Plan.

Second, the Comprehensive Expenditure Review saves money but leaves the government still doing too many things. It is not deliberately getting out specific program areas - as of now, anyway. It used the process to tweak here and there to save money (big dollars, truth be told as you see from the box of initiatives above) but it has not identified federal roles it will no longer be doing. This creates an inevitable incentive for the shoots of government to grow back after they’ve been shorn. Want real, lasting savings? Pull the shoots from the roots. And, no, winding down the Two Billion Tree program, however welcome, does not really count!

Third, it is not (wisely) a one-size-fits-all set of cuts. Two levels of cuts (15% and 2%) differentiates priorities so some across-the-board targeting. But, overall, departments and agencies are granted some discretion on how they achieve their assigned targets. Meet the target but do it in the way that fits your needs. This is a sensible approach but still requires central oversight.

Fourth, AI is not the promised productivity panacea. AI, a much-touted harbinger of better public servant productivity, is mentioned specifically only in the case of two agencies as a way to save money - CRA and CRTC. This suggests AI is being seen as a more broad-based, generalized productivity enhancement tool from which undefined savings will accrue. This is shown on page 215 of the Budget which lists 4 other departmental examples of using AI for back-office and routine or common activities. Then there’s this eye-opening gem: “Budget 2025 also announces that Shared Services Canada, in partnership with the Department of National Defence and the Communications Security Establishment, will develop a made-in-Canada AI tool that can be deployed across the federal government.” Phoenix pay-system redux? Keep an eye on this! Finally, can’t leave without noting the continued failure to publish the report from the Treasury Board’s Working Group on Public Sector Productivity, announced more than a year ago. [I wrote my own thoughts on this topic here.

Fifth, we are not done yet. Detailed departmental estimates will reveal more specific cuts - oops, sorry, “modernisation” - that will create more localized pain for numerous Liberal-fed policy and political constituencies of the past. More importantly, and welcomingly, the Budget says the government will adopt “a regular, predictable review schedule to ensure continuous optimization of resources. Future reviews will focus on specific horizontal themes, such as consolidating the administration of programs, fostering AI implementation and scale-up in the public service, and reviewing business subsidies and skills programming.” More savings will be reported on next year’s budget.

Accountability Begins Here

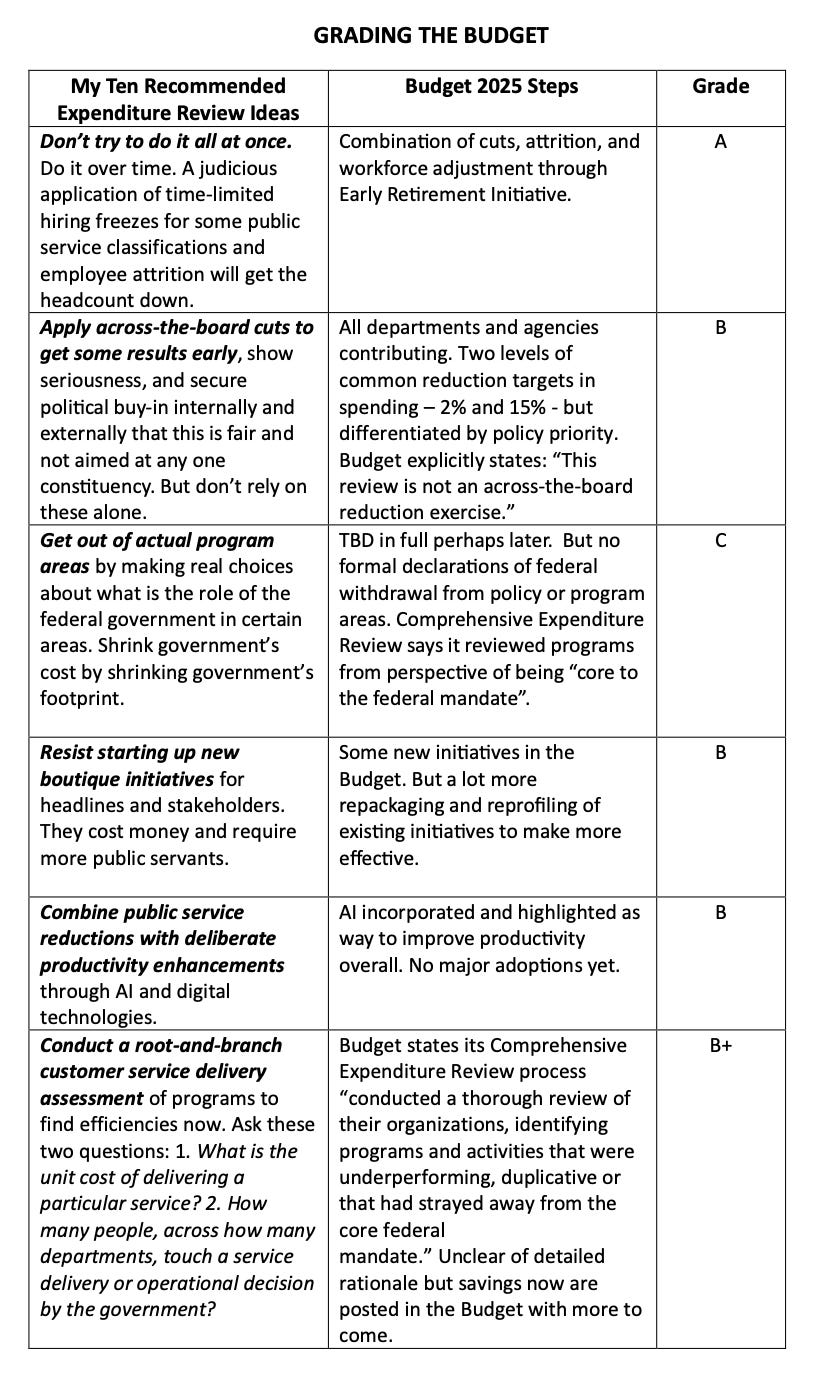

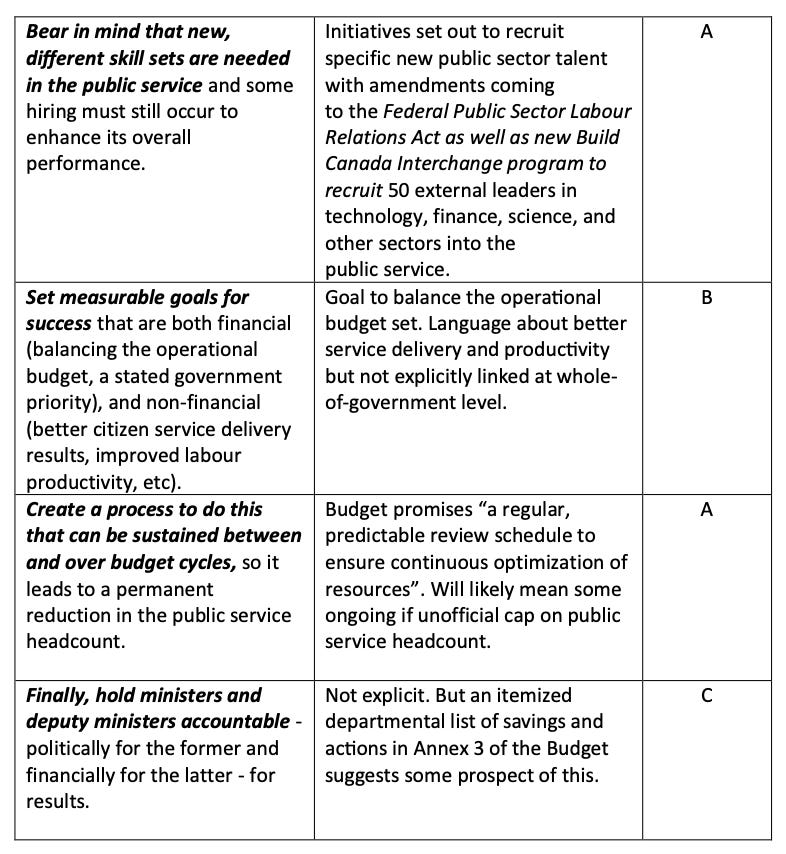

Back in early August, I compared the DOGE approach in the US with what should be done in Canada instead. I offered 10 recommendations. Below, I grade the Budget’s response to them. Your grading may vary, and execution is what really matters, but not bad, overall.

[Here’s the full post from above.]

Canada’s Federal Spending Reviews, Canada School of Public Service, 2025, pg. 6.

ibid. pg. 13

Great analysis and depth of knowledge about how Government spends.

This is a good workup showing a feasible plan that should not be defeated by opposition slogans with no real plan.