Canada Day marks just over 100 days of Mark, as in Carney. Since being sworn in as prime minister on St. Patrick’s Day, our new prime minister has enjoyed no small ‘luck of the Irish’ to win an election he wasn’t supposed to.

Napoleon once said he would rather have a general who was lucky than one who was good. So far, Mr. Carney has been both lucky and good. Lucky to have Donald Trump in the White House, and pretty good at winning elections and being prime minister.

He may have been green going into the job as PM and party leader, but Mr. Carney is proving no novice in the role. He single-handedly powered his party and government into an unprecedented fourth term in office. Since then, he has embarked upon a rapid-fire series of actions and changes to achieve his goal to “build the strongest economy in the G7”. Internal trade barriers to come down; major energy and infrastructure projects to be built faster; defence spending to rise higher and sooner than anticipated.

Mr. Carney clearly does not lack for ambition. “We will need to think big and act bigger. We will need to do things previously thought impossible at speeds we haven’t seen in generations”, he said in his victory speech. But what if this big ambition isn’t matched by business, big or small? What if the public doesn’t share his vision that Canada is at a “hinge moment of history”, as he put it?

The prime minister is inheriting a country more risk averse and complacent than it should be. A country more righteous than realistic about its place in the world – “the world needs more Canada”, we intone. A country too comfortable in its entitlements and expectations, real or imagined.

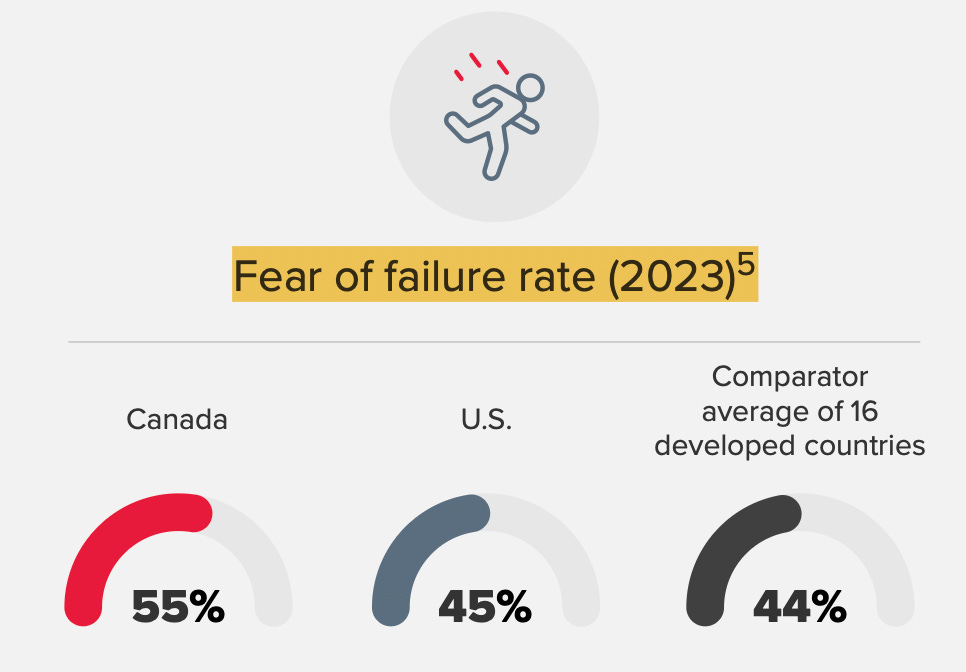

That risk aversion carries over to the business community. According to a 2023 survey by the Conference Board of Canada, when it came to innovation, more than half of Canadian entrepreneurs stopped doing more because they feared failing. That was ten points higher than for businesses in the U.S. and across sixteen other developed countries. Part of this is a weaker industrial and research ecosystem that successfully carries innovation to market, but there’s no denying a CEO mindset alongside.

Source: BDO Canada, “Canada’s Productivity Paradox”, Feb. 2025

That mindset won’t be easy to dislodge. It has been fed for more than a quarter-century by easy access to the largest market in the world, our next-door neighbour. It has been nourished of late by low-cost labour and high immigration. And it has been enticed into a rent-seeking, subsidy-demanding, high-consumption, low-value manufacturing economy by companies and governments hooked on handouts.

The result: Canadian businesses have become less competitive and more risk-averse when it comes to investing in innovation, technology, and people needed to build more wealth.

Consider the results. Canada’s economy today is actually smaller than it was in 2019, adjusted for inflation and immigration.1 We’ve fallen from the sixth most productive advanced economy in the world in 1970 to the eighteenth today. Average annual labour productivity growth was less than half of what it was in the U.S. in the twenty-year period from 2001 to 2021.

Source: BDO Canada, “Canada’s Productivity Paradox”, Feb. 2025

We’ve deindustrialized, with manufacturing contributing less than half of what it did to the economy in 2000.2 Capital investment spending levels are lower than they were a decade ago. The business innovation rate in 2022 was 36 percent in Canada, far below the 50 percent rate in America and the 45 percent rate for other advanced industrial economies in the world.

Source: BDO Canada, “Canada’s Productivity Paradox”, Feb. 2025

Unless these trends are changed, the OECD predicts Canada will be enjoy the worst performance of advanced member countries over the next four decades as measured by real GDP per capita. That means lower living standards for Canadians and less economic wealth generated to invest in health care and education.

Blaming government is always easy and fashionable. But these are structural problems not easily fixed, due to years of tepid investment and innovation decisions by business themselves. Government policies may have contributed but it’s the CEO and the board of directors or the entrepreneur and innovator who made the calls.

“Sell the beach, not the flight” is the classic travel agency business model. For too long, our politicians have practiced the political equivalent to voters. Big goals and grand pronouncements were set without telling people that the journey might be long and hard. “Inconvenient truths”, as in climate change, were traded for “reassuring fibs” so everyone could have “their nice things”.

Applying this same mentality to this time of economic emergency would simply invite more failure. The PM may be moving at the speed of need now with his checklist of initiatives. But “thinking and acting big” requires an overdue mind-shift by Canada’s business leaders, investors, and entrepreneurs.

Mr. Carney needs to confront complacency with candour. He told voters what he planned to do. Now he must tell business what they need to do. His “hinge moment” hinges on it.

My weekly Saturday column as published in Winnipeg Free Press.

RBC Economics, “Canada’s Growth Challenge: Why the economy is stuck in neutral”, 2024

RBC Economics, “Canada’s Growth Challenge: Why the economy is stuck in neutral”, 2024

The silence from the Canadian Council of Chief Executives is troublesome. Back in the D’Aquino era they were very engaged in the public discourse and public policy. Are they playing defence or offence? Nation building is a team sport.

Why don’t we buy from Canada as individuals instead of the MAGA companies and corporations?