The game’s afoot! The federal money tree is about to be shook. And, for the first time in years for bureaucrats, the shakedown is internal, focused on government itself. Let’s explore what this means for government today with a journey down memory lane to governments of yesterday.

But first, some scene setting.

Cabinet ministers and their departments were formally instructed this week in a letter from the finance minister to identify and bring forward “ambitious” program and operational savings for the Fall budget. How much?

Here’s the ‘money quote’ according to one news report:

7.5 per cent in the fiscal year that begins April 1, 2026;

followed by 10 per cent in savings the next year;

and 15 per cent in the 2028-29 fiscal year.1

But what does this add up to? It depends on two things: first, the base amount - the % of X, with X being the operational spending definition; and second, whether the cuts are additive or cumulative.

Without the full letter and any other details, we must rely on news reports, with one article pegging the base amount - or X - as around $190 billion. By 2028, that is meant to add up to annual savings of between $21 billion2 or $25 billion or $28 billion (depending on which news story you read).3

If these figures are correct then the percentage savings are cumulative winding up at 15% in 2028 rather than additive which would wind up at over 30%. If additive, the annual would be north of $75 billion per year, nowhere the numbers being leaked by unnamed government officials to journalists.

Still, that amount is edging up to be twice as much in annual savings as the Liberal platform promised, so it’s a big deal. We’ll only know for sure though when the Budget is tabled in Parliament. Even then, the Liberal government of Justin Trudeau had a worrisome habit of writing their deficit reduction and cost saving targets in disappearing ink, so feel free to guess for yourself.

The 2028 date is important. That’s when Prime Minister Carney promised to balance the operational budget of the government of Canada:

“Balance the operating budget by Budget 2028, ensuring responsible fiscal management while making wise, long-term investments to build for Canada’s prosperity and future.”

Here’s the rationale, again as set out in news reports since Finance Minister Francois-Phillippe Champagne’s letter has not been made public in full.

“You will be expected to bring forward ambitious savings proposals to spend less on the day-to-day running of government, and invest more in building a strong, united Canadian economy,”

This is a reprise of the Liberal platform refrain to “spend less, invest more”. Less on government operations and more on government capital. In truth, this is actually a reallocation commitment not a deficit elimination commitment. Basically, not to balance the whole federal budget but only one (significant) part of it - that comprising government’s own operations. Here’s how the Liberal platform put it:

“More than half of incremental expenditure over the next four years will be capital related, driving significant growth in our housing stock, defence equipment, and the private sector capital base. At the same time, we will bring revenues in line with total operating spending and eliminate this gap – currently estimated at about $15 billion a year – by Budget 2028.”

The simple explanation is this. They need money to pay for their new initiatives, particularly national defence which is to grow by some $9 billion more this year alone, and the new middle class income tax cut that came into effect on July 1st.

All these theoretical savings will come out of two theoretical buckets: Bucket #1: reallocated savings derived internally from this expenditure review of program and services; Bucket #2: improved productivity derived from more efficient government operations, service delivery, and public service head count.

Fair enough. That’s the premise as to ‘where to look’ for money, but ‘how to look’ for the money? Without a common assessment framework ministers cannot accurately figure out how to make informed political choices. More to the point, whether they are being bamboozled by bureaucratic bafflegab in what their officials put in front of them.

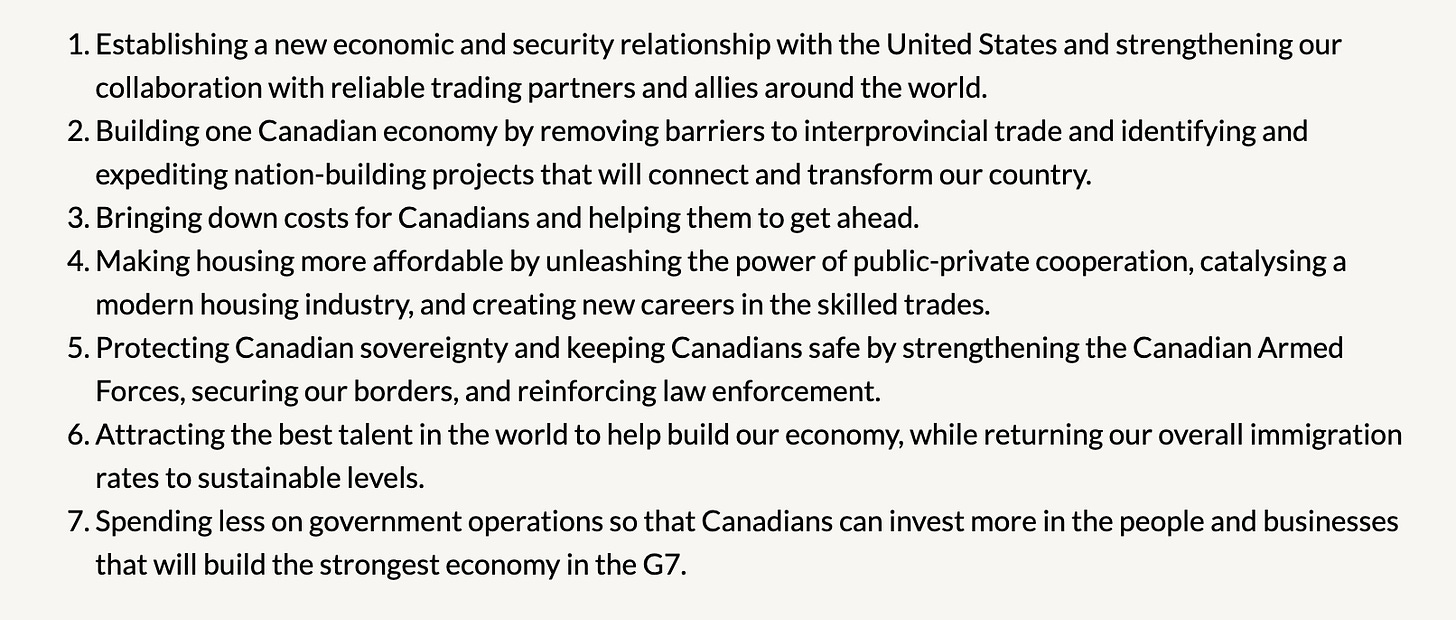

The finance minister’s letter evidently provides a three-point, high level assessment framework:

“Through this ambitious review each minister should examine the programs and activities in their portfolio to determine which are: (1) meeting their objectives, (2) are core to the federal mandate, and (3) complement versus duplicate what is offered elsewhere by the federal government or by other levels of government”. (bold and numbering added)4

Muscle Memory and the 1995/96 Expenditure Review

Here’s the memory lane part. It’s been many, many years since the public service has actually conducted a top-to-bottom (or bottom-to-top, if you like) expenditure review. You have to go back to the Prime Minister Jean Chretien and Finance Minister Paul Martin years of 1994-1996, to be exact.5 [Prime Minister Stephen Harper directed two more modest savings efforts during his time in office but not of the same scale.] That means there are literally zero senior public servants now in place with any actual experience at managing the 2025 exercise. Talk about on-the-job learning!

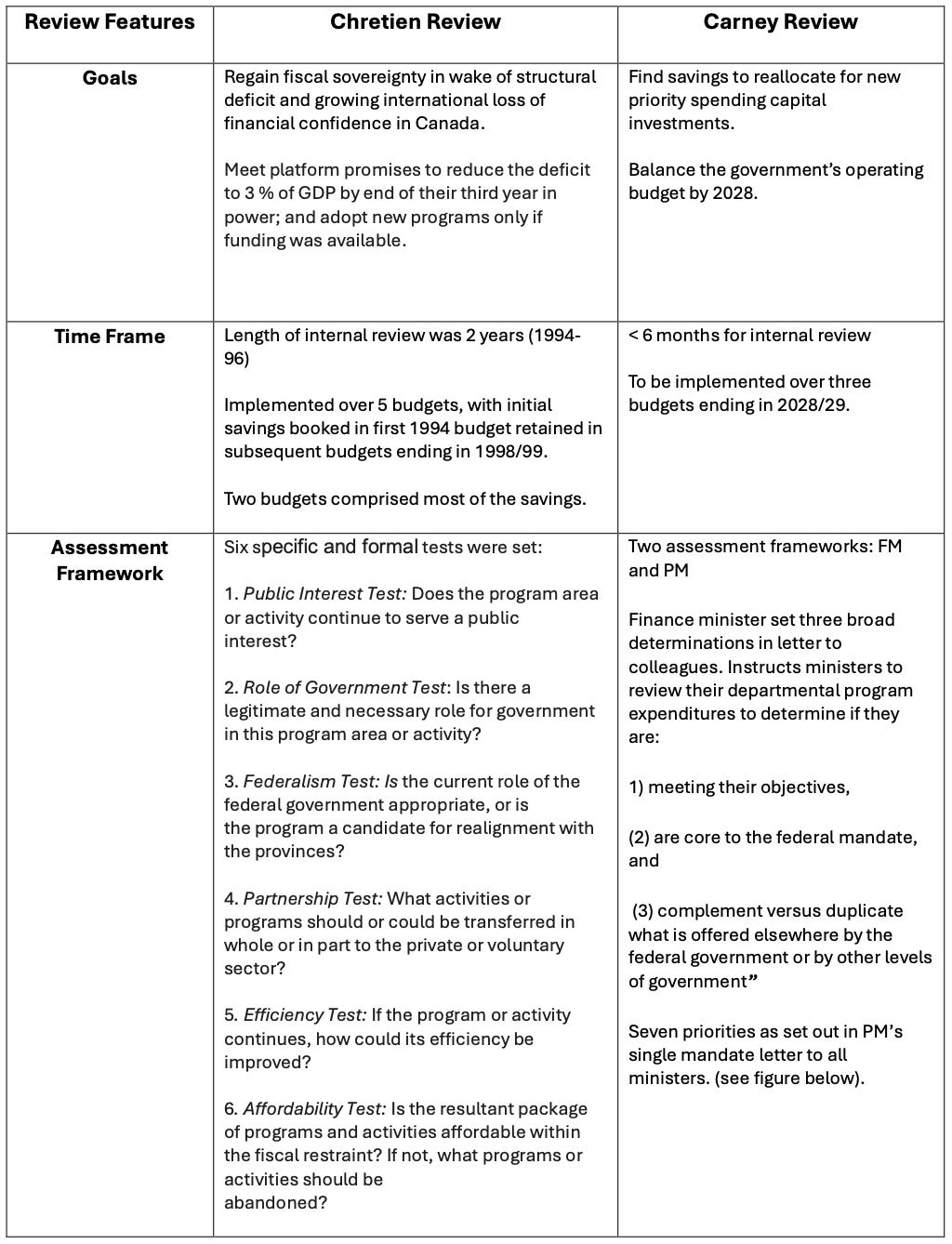

A comparison of scope and results from the Chretien review is instructive to help us anticipate what might emerge from the Carney review. Here is a high-level summary table I prepared:

PM Carney’s Mandate Letter Priorities

The Chretien review was bigger in scale than the anticipated Carney review. Almost all federal transfer categories were reviewed under Chretien - individuals, governments, businesses, operations - rather than just operations as it looks now under Carney. There were absolute cuts under Chretien not just anticipated reductions in spending growth that may yet appear under Carney. Chretien sought to balance the whole government of Canada budget not just the operational budget Carney is focusing on. The figure below from the Fraser Institute shows the absolute reduction in federal program spending following the Chretien review.6

Still, it ain’t nothin’. The Liberal savings target is almost twice as large as set out in their election platform. And they have promised to achieve this within three years AND without public service layoffs.

Finance minister Paul Martin’s second budget was his most consequential, not his first. It was the second one that put Canada onto the road of financial recovery, beginning the slow but steady decline in national indebtedness leading to balanced budgets for the first time in decades. So, missteps and course corrections do happen.

Finance minister Champagne has already had his course correction, courtesy of the PM who announced, yes, there would be budget this Fall after Champagne had demurred on the whole idea a couple of days before. Now, Champagne is enmeshed in the most expensive expenditure review process in thirty years for his first budget as finance minister.

10 Questions

There are two important ways to look at the upcoming review: Government Finances and Government Priorities. The first encompasses whether and how the government gets a grip on its own internal affordability and management. The second encompasses what role the federal government plans for itself in the economy and society and in relation to other levels of government.

This generates ten key questions for me:

Will the government achieve its goal of an operating surplus in FY 2028/29 and by how much?

What progress will this mean - if any - for balancing the entire federal budget?

How much in the way of savings came from absolute reductions in program and operational spending versus reductions in planned growth set out in previous budgets?

What proportion of savings is coming from defined program and departmental spending versus general productivity or efficiency improvements?

What will the public service head count after the review is fully implemented and what interim steps are planned such as a hiring freeze, layoffs, or attrition?

What program, spending, and capital priorities will be most reduced versus those that will not be reduced signalling what is core to this federal government?

What new investments in productivity such as AI and digital technologies and applications are planned?

Will the government set out metrics for results, outcomes, and effectiveness for programs and services?

Will this be accompanied by any specific public service reforms to improve productivity and service outcomes for Canadians?

What will the federal government STOP doing entirely or seek to handover to other levels of government?

Answers … sometime in the Fall!

Globe and Mail, Cabinet ministers asked to find ‘ambitious’ spending cuts as Carney government prepares first budget, July 7, 2025.

Toronto Star, Carney ministers told to cut billions from federal spending, July 7, 2025

Globe and Mail, Cabinet ministers asked to find ‘ambitious’ spending cuts as Carney government prepares first budget, July 7, 2025; Toronto Star, Brace for layoffs, budget watchdog says, as Carney government aims to slash spending by $25B, July 9, 2025; Globe and Mail, The Liberals launch another expenditure review: This time, we mean it, July 9, 2025

Globe and Mail, Cabinet ministers asked to find ‘ambitious’ spending cuts as Carney government prepares first budget, July 7, 2025.

See The Canadian Federal 1994–1996 Program Review: Appraising a Success 25 Years Later, Geneviève Tellier, in Policy Success in Canada: Cases, Lessons, Challenges, Evert Lindquist (ed.)

https://www.fraserinstitute.org/sites/default/files/2025-03/30th-anniversary-of-the-1995-budget.pdf, pg. 6

appreciate having this comparison.

There are certainly some lessons learned that could be drawn from both the Cretien and Harper era program reviews. In many cases, these lessons learned found thier way into OAG reports, particularly as they related to the tendency of departments to slash back-office oversight and administration in order to preserve programs. The 90s saw many departments introduce ERP technologies that were supposed to yield savings that never materialized. Instead we ended up with several egregious examples of mismanaged programs (Sponsorship, Champagne affair, Phoenix, F35 program, ArriveCan) because some senior officials were led to believe that expensive systems and processes could replace fundamental internal controls that was being done by people previously. And now we're just going to repeat the mistakes of the past by 'leveraging AI'?

The article does make one point that is just as true now as is was during prior exercises- there is no bench strength in the PS to undertake these reviews. Meaning that there will likely be an overreliance on consulting houses - again.

We will get our savings just like we have in the past.

However there will be no true review of programs or departments.

And 10 to 15 years hence, we will be back in the same place.